In Los Angeles, there’s a wholesale merchandise liquidator called Via Trading—where product misfits are given a second life. You get the idea if you’ve ever seen the A&E show Extreme Unboxing. People bid on pallets of returned merchandise, hoping to resell valuable products for profit as they weed through tons of broken and unsalvageable items. The show, and the salvagers, are profiting off the underbelly of the recent eCommerce boom—as online shopping has escalated, product returns have, in turn, spiked by 95%.

While returns are a necessary part of the shopping experience – both in-store and online – deep-pocketed brands like Amazon and Costco changed the game forever by offering free shipping on returns and uber relaxed policies (like allowing this woman to return a dead Christmas tree in January). With these policies, shoppers have the liberty to order a new fleece in a range of sizes – a process called bracketing – and send back the ill-fitting ones. But, what happens to returned items is the stuff of sustainability nightmares and a massive drain on bottom lines for brands across the board.

We won’t go too far down the rabbit hole, but here’s a quick overview for those who aren’t in the industry. Some brands will take a product back and resell it, often refurbished or wholesale (an increasingly rare practice); some will let the customer keep it and issue a refund. In contrast, others will dump unwanted items in a landfill, ship them overseas for sale or disposal, or sell them to liquidators. This issue isn’t as prolific for brick-and-mortar stores, with product returns in the single digits – thanks to dressing rooms and shoppers handling products in-person – but the average return rate is between 15-30% for online retailers. Following the 2021 holiday shopping season, the National Retail Federation predicted $158 billion of merchandise returned from online and in-person shopping—from holiday purchases alone. A heavy price to pay for not getting it quite right.

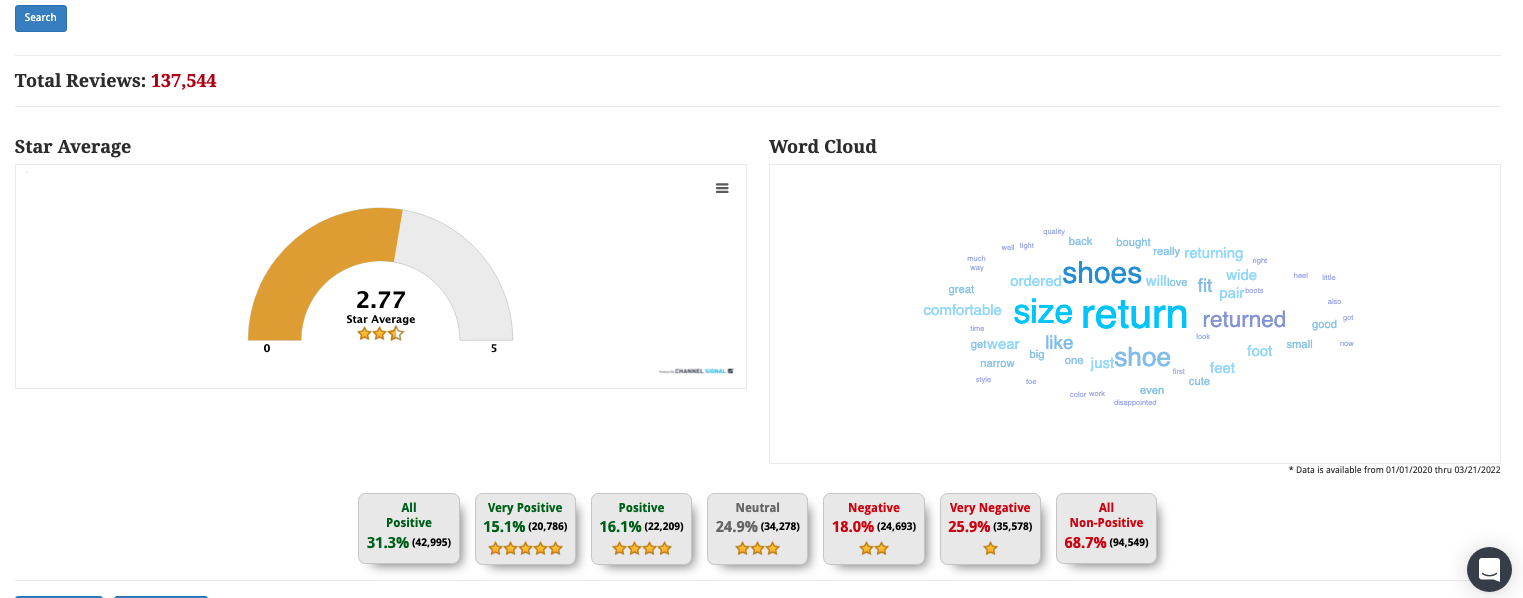

For retailers, returns are closely tied to customer loyalty. Consumers want to shop confidently, knowing that if size, fit, color, quality – or even knock-off items – are an issue, the product can be returned, no questions asked. We went back one year and analyzed 137,544 reviews on returns. Here’s the visual information.

Yes, the star average is low and that is for many reasons. Three issues stood out in footwear and apparel; fit, color, and the return policy. We have done deep research in this area and found that brands having a precise fitting chart have far fewer returns than brands having just the standard chart.

“I ordered using the True Fit Chart and it caused me to buy a bigger boot than I needed.”

Athleta is a good example of an extensive inclusive fitting page where all shapes and sizes are addressed.

Color is a big issue because what is displayed on a brand’s website may not be what it is when a customer opens the package.

“The shoes are great but the color of this pair is deceptive. They appear almost black in the pictures but are actually very sparkly with bright colors. Not my style so I returned them.”

Consumers believe that what they see on their monitor is exactly what they should be getting. The problem gets sticky because the problem may be their monitors and not the website. However, making sure the website portrays exactly the color is important.

And last is the return policy. Amazon has set a high benchmark here, and consumers don’t like it when other eCommerce partners or the brand don’t live up to the Amazon standard.

“Now I get stuck paying the return. I’m ready to shut my QVC and HSN cards down because of their return policies. Amazon offered free returns!”

Tapping directly into consumer sentiment and getting to the bottom of return issues will save your company money and increase margins.

With the Channel Signal platform, you can see what consumers are writing about in their product reviews in near real-time. With access to all of the reviews in the marketplace, not just 30%, you will get an accurate analysis of returns, why they are returning, and a roadmap to reducing them. At the end of the day, fewer returns translate to more revenue and more importantly, happy customers—a winning strategy.